According to provisional data, GDP was 4.6% in 2017, compared to 2.9% in 2016. Domestic demand continues to be the major factor promoting the growth. Here, domestic demand is understood as total consumption and accumulation. Yet, it is mainly consumption that contributed to the economic growth in 2017. Naturally, the improvement was facilitated by the favourable situation on the labour market (a increase in salaries and a drop in unemployment) and the governmental programme “500+” as well.

Domestic economic situation

The second component of domestic demand is accumulation in the case of which consideration should be given to the gross fixed asset formation (commonly referred to as investment). After the very weak year 2016, a slight increase (of 0.9%) was observed not earlier than in the second quarter of 2017. 3rd quarter brought an increased investment activity as the investment dynamics accelerated to 3.3%, still a relatively low result. With such improvement in consumption, investment activity should have developed much quicker. The quoted 5.4% increase in the gross fixed asset formation in 2017 suggests that investment activity became much more intensive in quarter 4. It is visible that investments financed with EU budget framework for 2014-2020 have become more sizeable. However, it should be stressed that investments made up only about 17% in the structure of GDP in Poland. At present, the main role is played by public investment, in particular local-government investment. To lead to a rise in the share made up by investment in GDP, an increase should be recorded in private investment, a figure which is still low. The economy requires innovative actions in the private sector, but the companies’ trust in the state is fragile. The feeling that there is no stability inter alia in the scope of law translates into abandoning investments. A low investment level equals a low prospective rise in GDP in the future. Therefore, information about the Polish GDP can be perceived in two ways. On one hand, everyone should be pleased with the country’s high economic growth amounting to 4.6%. On the other hand, the GDP structure proved that the foundations of the growth are shaky. Unchangeably, it is consumption that is the driving force behind the economy, while it is investment that should come to the fore instead, since investment activity guarantees sustainable economic growth.

Construction market

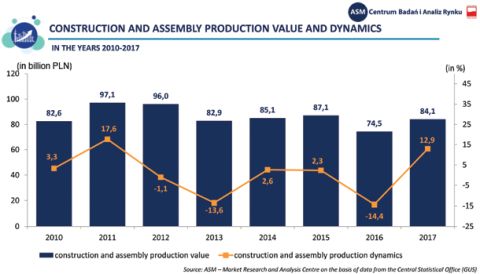

In 2017 the construction and assembly output reached PLN 84.1 billion, which is 12.9% more than a year before. After the weak 2016, the industry has taken the path of growth, and a number of projects started under the EU budget framework for 2014-2020 will let it stay on it. However, it should be stressed that the high two-digit rise in 2017 did not result so much from dynamic investment activity as from the low reference figures. If it was 2015 that was taken as the reference period, then the dynamics of construction and assembly production in 2017 would be -3.4%. Indeed, the construction industry is gathering momentum, but it needs to be said that the recovery process is slow. Considering the contemporary market situation, one should look at the construction industry in a wider perspective by taking into account not only the very last year, but also other preceding years. Referring the data only to the unimpressive year 2016 can give an incorrect image of the real situation in the sector. When comparing the volume of construction and assembly output over 2010-2017, one should note that a quantity rise was recorded only in reference to 2013 (1.4%) and 2010 (1.9%) (apart from the year 2016). We are far from the volume achived in 2011-2012 when the figures were over PLN 10 billion higher than now.

At present, the sector is on the path of growth, and a number of projects started under the EU budget framework for 2014-2020 will let it stay on it. The forthcoming months are expected to bring even more positive results, yet dramatic rises are still to be waited for. Nevertheless, it is worth stressing that 2018 will be a year in which new investments will be started, and also a period during which a lot of challenges will need to be faced: a lack of qualified workforce, a higher cost of investment resulting from a rise in prices, increasing labour costs and an accumulation of tender procedures.

Residential construction

In 2017 a record-high number of flats was completed – 178,258 residential units (RU). That was 9.1% more than in 2016 and 20.7% more than in 2015. A month-by-month analysis shows that the greatest rise was recorded in July, when 17,340 flats were completed - 34.6% more than in the corresponding month in 2016. In terms of the number of completed dwellings, it is quarter four that turned out to be the best as 53,915 residential units were completed then.

The residential market unchangeably continues to be dominated by private housing investments and investments for sale or rent. Their total share in residential construction in 2017 was 96.8% - 0.5 pp. higher than in the corresponding period in the preceding year. By 2015 it had been individual investors who took the first place in terms of the number of completed flats. However, in 2016 for the first time “the Smiths” were outstripped by property developers whose share in the total number of completed flats reached 48.5%. In 2017 the developers’ construction prevailed in the structure of all completed flats.

(...)

Beata Tomczak

Chief Market Analyst

ASM

Marta Łuszczyńska

Project Manager

ASM

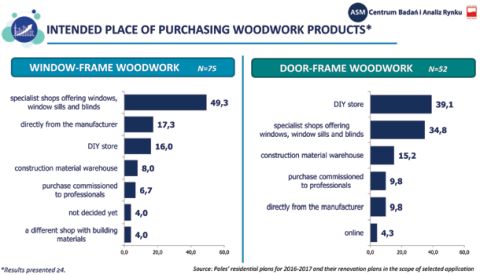

The article has been written on the basis of data from reports Window-frame woodwork market in Poland in 2017 [Rynek stolarki okiennej w Polsce 2017] and Door-frame woodwork in Poland in 2017 [Rynek stolarki drzwiowej w Polsce 2017] prepared by ASM – Market Research and Analysis Centre on behalf of the Polish Windows and Doors Association and reports Monitoring of the Construction Market [Monitoring Rynku Budowlanego] and Poles’ residential plans for 2016-2017 and their renovation plans in the scope of selected application [Plany mieszkaniowe Polaków 2016-2017 oraz plany remontowe w zakresie wybranej aplikacji] prepared by ASM – Market Research and Analysis Centre. Should you be interested in purchasing expert reports and detailed market analyses, you are welcome to contact us on our email:

The authors presented a similar topic at the 30th Technical Conference organised by the magazine “Świat Szkła” on 7-8 December 2017.

Całość artykułu w wydaniu drukowanym i elektronicznym

Inne artykuły o podobnej tematyce patrz Serwisy Tematyczne

Więcej informacji: Świat Szkła 03/2018